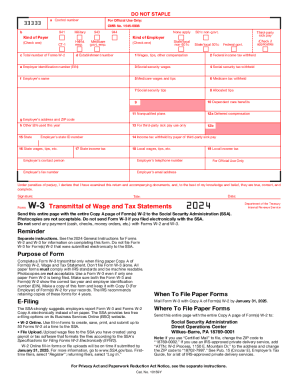

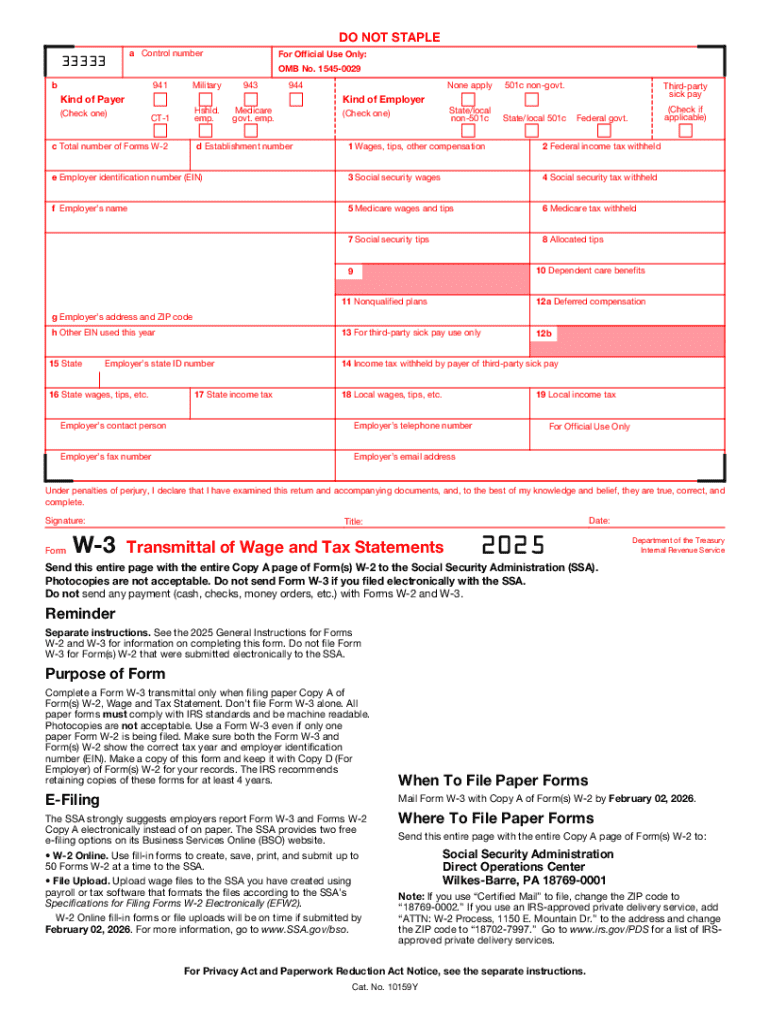

IRS W-3 2025-2026 free printable template

Instructions and Help about IRS W-3

How to edit IRS W-3

How to fill out IRS W-3

Latest updates to IRS W-3

All You Need to Know About IRS W-3

What is IRS W-3?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS W-3

What should I do if I realize I've made a mistake on my IRS W-3 after submission?

If you discover an error on your IRS W-3 after submission, you can submit a corrected version. Make sure to mark it as 'corrected' and include the correct information. It's essential to notify the IRS as soon as possible to avoid issues with your filings.

How can I verify the status of my IRS W-3 submission?

To verify the status of your IRS W-3 submission, check the IRS e-File status page if you filed electronically. If you mailed your form, consider contacting the IRS for confirmation of receipt and processing status, as delays can happen during peak times.

What are some common errors that filers make on the IRS W-3?

Common errors on the IRS W-3 include mismatched names and Social Security numbers, incorrect tax year, and failure to sign the form. Double-checking all entries against records can help minimize these mistakes.

Are there any specific privacy or data security considerations while filing IRS W-3 online?

When filing the IRS W-3 online, ensure that you use secure connections and trusted software. Be cautious about sharing sensitive information and maintain records securely to protect against data breaches.

What should I do if I receive a notice from the IRS after filing my W-3?

If you receive a notice from the IRS regarding your W-3, read it carefully, follow the instructions provided, and gather any necessary documentation to respond promptly. Ignoring the notice may lead to further complications.

See what our users say